All Categories

Featured

Table of Contents

The are entire life insurance policy and universal life insurance policy. expands cash value at a guaranteed passion price and also through non-guaranteed rewards. grows cash money value at a fixed or variable rate, depending upon the insurance company and policy terms. The cash worth is not contributed to the death advantage. Cash worth is a feature you benefit from while alive.

The plan loan passion rate is 6%. Going this route, the interest he pays goes back into his policy's cash money value instead of a financial organization.

Think of never having to stress over small business loan or high rate of interest once more. Suppose you could borrow money on your terms and develop riches concurrently? That's the power of unlimited banking life insurance policy. By leveraging the money worth of whole life insurance policy IUL policies, you can grow your wide range and borrow money without relying upon typical banks.

There's no set financing term, and you have the flexibility to select the payment routine, which can be as leisurely as settling the car loan at the time of fatality. This versatility reaches the maintenance of the lendings, where you can select interest-only settlements, keeping the finance equilibrium level and manageable.

Holding money in an IUL fixed account being attributed interest can often be much better than holding the cash on down payment at a bank.: You've always desired for opening your own pastry shop. You can borrow from your IUL plan to cover the first expenditures of leasing a space, purchasing equipment, and working with team.

Cash Value Life Insurance Infinite Banking

Individual fundings can be acquired from typical banks and lending institution. Here are some vital factors to take into consideration. Credit scores cards can offer an adaptable means to borrow money for really temporary periods. Obtaining money on a credit card is generally very costly with yearly percent prices of interest (APR) typically reaching 20% to 30% or even more a year.

The tax obligation therapy of plan lendings can vary considerably relying on your country of residence and the certain regards to your IUL policy. In some areas, such as North America, the United Arab Emirates, and Saudi Arabia, plan fundings are normally tax-free, offering a substantial advantage. In various other territories, there might be tax obligation effects to take into consideration, such as possible taxes on the funding.

Term life insurance coverage only supplies a death advantage, without any kind of cash money value accumulation. This means there's no money value to borrow against.

Banking Life Insurance

When you initially hear about the Infinite Financial Principle (IBC), your very first reaction might be: This appears also good to be real. The issue with the Infinite Banking Concept is not the concept yet those persons using an adverse review of Infinite Banking as a concept.

As IBC Authorized Practitioners through the Nelson Nash Institute, we thought we would respond to some of the top inquiries individuals search for online when discovering and recognizing everything to do with the Infinite Banking Idea. What is Infinite Financial? Infinite Financial was produced by Nelson Nash in 2000 and totally discussed with the publication of his book Becoming Your Own Banker: Open the Infinite Banking Concept.

How Infinite Banking Works

You think you are coming out monetarily ahead due to the fact that you pay no rate of interest, yet you are not. When you conserve cash for something, it usually indicates giving up something else and reducing on your way of life in various other areas. You can duplicate this procedure, however you are merely "shrinking your means to wealth." Are you pleased living with such a reductionist or shortage frame of mind? With saving and paying money, you may not pay passion, however you are using your money when; when you spend it, it's gone forever, and you give up on the opportunity to make life time compound interest on that particular cash.

Billionaires such as Walt Disney, the Rockefeller family and Jim Pattison have actually leveraged the homes of whole life insurance policy that dates back 174 years. Also banks make use of whole life insurance policy for the same functions. It is called Bank-Owned-Life-Insurance (BOLI). The Canada Revenue Agency (CRA) also identifies the value of getting involved entire life insurance policy as an one-of-a-kind property course used to produce long-lasting equity securely and predictably and give tax advantages outside the extent of conventional financial investments.

How Do You Become Your Own Bank

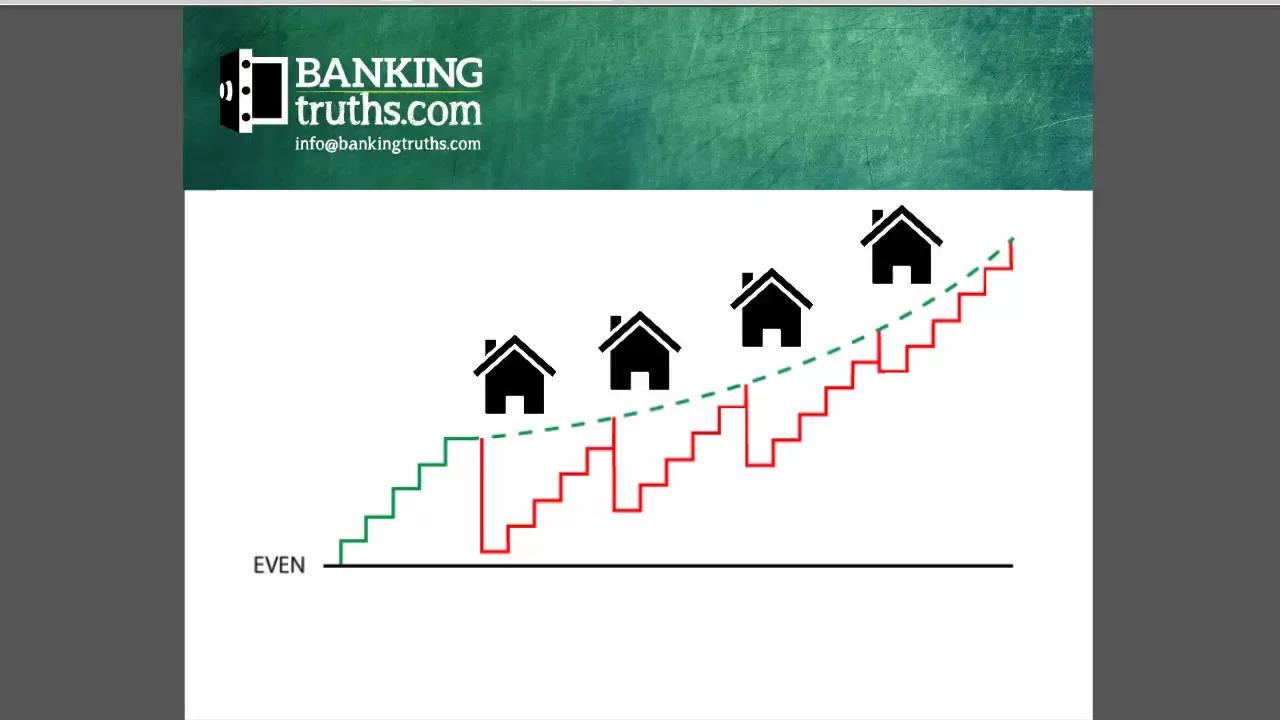

It enables you to generate wide range by satisfying the financial feature in your own life and the capability to self-finance significant way of life acquisitions and expenses without disrupting the compound rate of interest. One of the easiest means to assume about an IBC-type participating whole life insurance policy plan is it is comparable to paying a home loan on a home.

When you obtain from your taking part entire life insurance coverage plan, the money worth proceeds to grow continuous as if you never ever obtained from it in the initial location. This is due to the fact that you are using the money worth and death advantage as security for a funding from the life insurance policy business or as collateral from a third-party lender (understood as collateral lending).

That's why it's vital to deal with a Licensed Life Insurance Broker licensed in Infinite Banking that structures your getting involved entire life insurance coverage plan appropriately so you can stay clear of adverse tax effects. Infinite Financial as a financial strategy is except everyone. Here are several of the pros and disadvantages of Infinite Financial you should seriously consider in determining whether to progress.

Our recommended insurance service provider, Equitable Life of Canada, a shared life insurance policy business, concentrates on getting involved entire life insurance policy policies particular to Infinite Financial. Likewise, in a common life insurance policy company, insurance policy holders are thought about firm co-owners and receive a share of the divisible excess produced annually through returns. We have a selection of providers to select from, such as Canada Life, Manulife and Sunlight Lifedepending on the needs of our clients.

Please also download our 5 Top Questions to Ask A Limitless Financial Agent Before You Hire Them. To find out more about Infinite Banking go to: Please note: The product offered in this newsletter is for informational and/or academic objectives only. The details, point of views and/or sights expressed in this newsletter are those of the authors and not necessarily those of the representative.

Creating Your Own Bank

Nash was a financing expert and fan of the Austrian college of business economics, which advocates that the worth of items aren't clearly the result of typical economic structures like supply and need. Instead, people value money and products in a different way based on their economic status and requirements.

One of the mistakes of conventional banking, according to Nash, was high-interest prices on loans. Too many individuals, himself included, got right into monetary trouble due to reliance on financial institutions.

Infinite Banking requires you to own your monetary future. For ambitious people, it can be the most effective monetary device ever. Here are the benefits of Infinite Financial: Perhaps the single most beneficial facet of Infinite Financial is that it enhances your capital. You don't need to go through the hoops of a traditional bank to get a funding; simply request a policy car loan from your life insurance policy company and funds will certainly be provided to you.

Dividend-paying entire life insurance policy is really reduced threat and supplies you, the insurance policy holder, a lot of control. The control that Infinite Financial offers can best be organized into two groups: tax benefits and possession protections. Among the factors whole life insurance policy is perfect for Infinite Financial is just how it's tired.

Entire life insurance policies are non-correlated assets. This is why they work so well as the financial structure of Infinite Banking. Regardless of what happens in the market (supply, genuine estate, or otherwise), your insurance policy maintains its well worth.

Market-based investments expand wide range much quicker however are subjected to market fluctuations, making them inherently risky. What if there were a third bucket that offered safety and security yet likewise moderate, surefire returns? Whole life insurance is that 3rd bucket. Not only is the price of return on your whole life insurance coverage policy guaranteed, your survivor benefit and costs are likewise assured.

Infinite Bank Statements

This structure straightens perfectly with the principles of the Perpetual Riches Approach. Infinite Banking charms to those seeking better monetary control. Right here are its main benefits: Liquidity and access: Policy car loans provide prompt accessibility to funds without the limitations of traditional small business loan. Tax obligation effectiveness: The money worth grows tax-deferred, and policy loans are tax-free, making it a tax-efficient tool for building riches.

Possession security: In numerous states, the cash money value of life insurance policy is shielded from financial institutions, including an additional layer of monetary security. While Infinite Financial has its advantages, it isn't a one-size-fits-all solution, and it includes significant downsides. Below's why it may not be the most effective method: Infinite Banking frequently requires detailed policy structuring, which can puzzle policyholders.

Latest Posts

Infinite Banking System Review

Infinite Concept

Bank Account Options For Kids, Teens, Students & Young ...